Gifts in Your Will

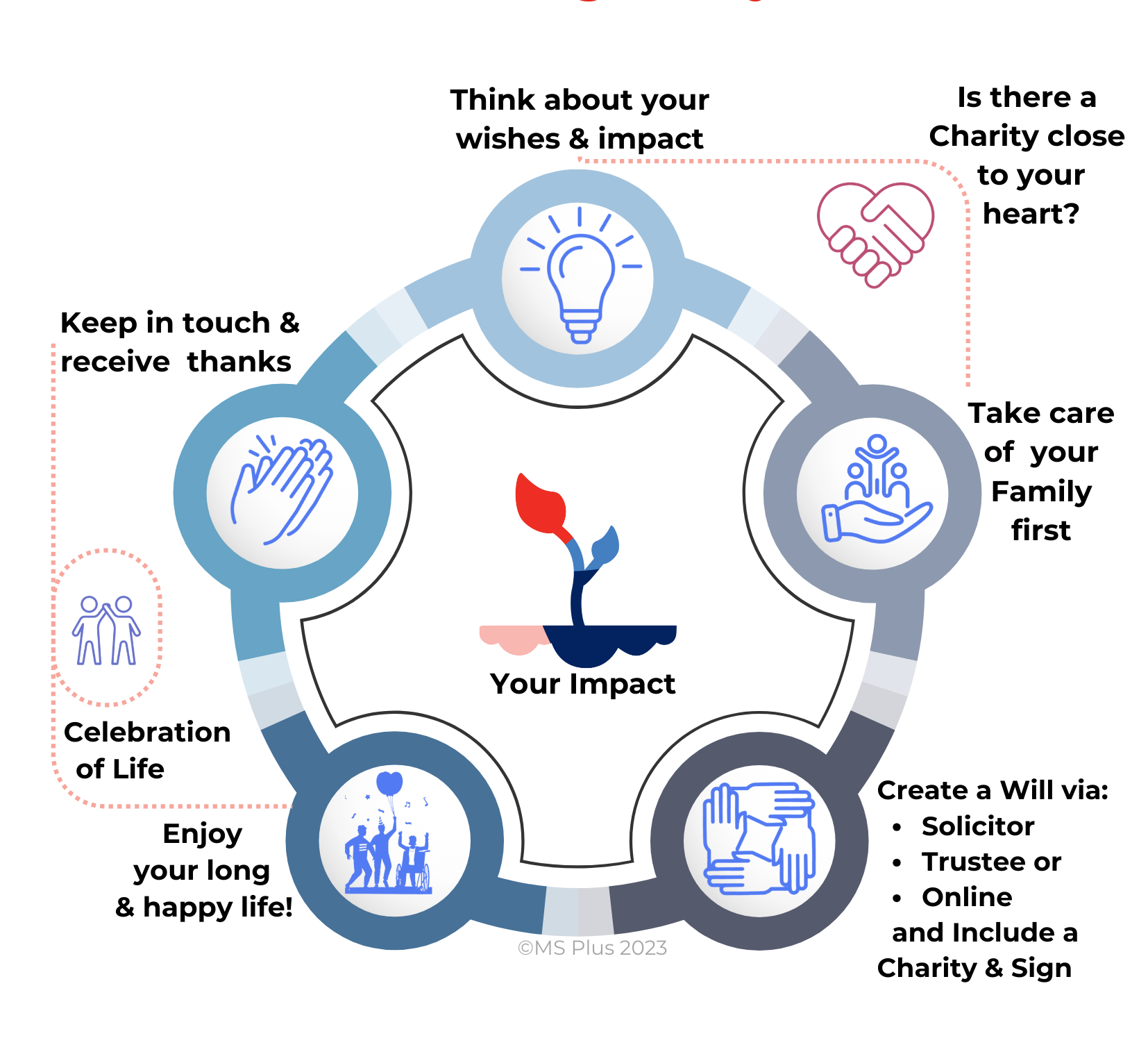

Leaving a gift in your Will is a great way of ensuring your wishes will be honoured but does not have to impact your current funds or quality of life. You can leave a gift in your Will or establish a Trust, that will help support those living with MS for years to come. We recommend that you see your Solicitor or Advisor to find out more. It can be as easy as:

If you have already included a gift to benefit the future of MS Plus, be sure to let us know so that we may best honour your wishes.

A gift in your Will is one of the easiest ways to create your legacy and offers the following benefits:

LASTING IMPACT

Your gift will create your legacy of love for those living with neurological conditions like MS.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

NO COST

Costs you nothing now to give in this way.

Five simple, “no-cost-now” ways to give in your Will

Residual gift

A residual gift in a Will leaves MS Plus the remainder of your estate after other gifts, debts and expenses have been fulfilled.

Specific gift

A specific gift in a Will leaves MS Plus a specific dollar amount or stated percentage of your estate or a specific gift in kind, such as collections, art, books and jewelry.

Family first gift

A family first gift in a Will leaves MS Plus a stated share of your estate, only if a spouse, family member, or other beneficiary does not survive you.

Contingent property-use gift

A contingent property-use gift in a Will allows for a person to continue to reside in the property for a set period of time or under certain conditions. This is also known as a right to occupy.

Life interest gift

A life interest gift in a Will allows for a spouse or other person to use your real estate property and receive any or all income derived from it during their lifetime. When they pass, the title in the real estate property can then be given to MS Plus.

Gifts by Beneficiary Nomination

It’s easy to put your superannuation benefit and insurance entitlements into your Will and instruct your Trustee to act on your wishes to direct to us in helping those facing MS live life to the fullest — and it costs you nothing now.

By naming MS Plus as a beneficiary of these benefits, you can power our mission for years to come and establish your personal legacy of compassion for people living with neurological conditions.

Potential benefits of gifts by beneficiary nomination:

Help reduce tax and ensure your wishes are honoured

Change your beneficiaries at any time

No cost to you now to give

Create your legacy with MS Plus

Types of Gifts

Superannuation fund residuals

Simply instruct your Superannuation Trustee to act on your wishes to ensure your superannuation is directed to us.

Insurance plan

You can name MS Plus as a beneficiary of all or a portion of your insurance plan. With this gift arrangement, MS Plus will receive the proceeds of your plan after your lifetime. You can change your beneficiary at any time and may reduce your taxes.

Private ancillary fund residuals

A private ancillary fund is a charitable trust that allows you to create your own personalised giving program. It is a private fund through which you make tax-deductible donations to support MS Plus, rather than making one-off donations. The donations you make are invested, managed, and distributed to support people with multiple sclerosis for years to come. The final distribution of contributions remaining in your private ancillary fund is governed by the contract you completed when you created your fund. We hope you will consider naming MS Plus as the successor for a portion of the account value, leaving the remaining portion for your heirs to continue your philanthropic legacy.

How to update a beneficiary nomination:

Simply contact your bank, insurance company or other financial institution to request a beneficiary nomination form. You may also be able to log in to your account and update your beneficiaries online.

Please use our legal name: MS Plus Ltd

Include our ABN number: 66 004 942 287

Please let us know so we can ensure that your wishes are carried out.

Complimentary Gift Planning Resources Are Just a Click Away!

Creative Ways to Make a Major Impact

Your Giving Toolkit

Sample Language for Your Will or Trust

Sample Beneficiary Nomination